Good Reasons To Deciding On Bohemia Coins

Wiki Article

How Can I Identify Trustworthy Gold Dealers And Sources In Czech Republic That Are Authorized And Dependable?

Verification Authenticity Check that the dealer offers a guarantee of authenticity. They must also supply the proper documentation or certificate with each purchase in order to verify purity and the source. Customer Service and Support - Evaluate the level of customer support they provide. Trustworthy dealers are committed to customer satisfaction, provide assistance and resolve questions or concerns promptly.

Experience and Longevity- Look at the past of the dealer and his expertise working in the field. Reliable, long-standing dealers could be more trusted.

Recommendations and Referrals - Ask suggestions from financial advisors, friends, or family members with expertise in purchasing gold. Referrals can be very valuable.

Comparison and Due Diligence Comparison and Due Diligence: Check out the products and prices offered by multiple dealers. Conduct due diligence prior to buying by verifying the information of the seller and performing background checks on the seller.

Be aware and be sure to conduct extensive research on any gold dealers before you engage them. Reputable dealers value transparency as well as authenticity and satisfaction, which means a safe and reliable transaction for your gold investment. Have a look at the most popular Czechia Gold blog for blog recommendations including best way to buy gold, gold bullion cost, gold coins, gold ira companies, gold ira, angel coin, gold and silver buyers near me, 20 dollar gold coin, george washington gold dollar, 1 4 ounce gold coin and more.

How Do I Ensure That The Quality Of Gold Coins Or Bullion I Purchase In Czech Republic?

To assure the authenticity of bullion and gold coinage in Czech Republic, there are several steps to be followed.-

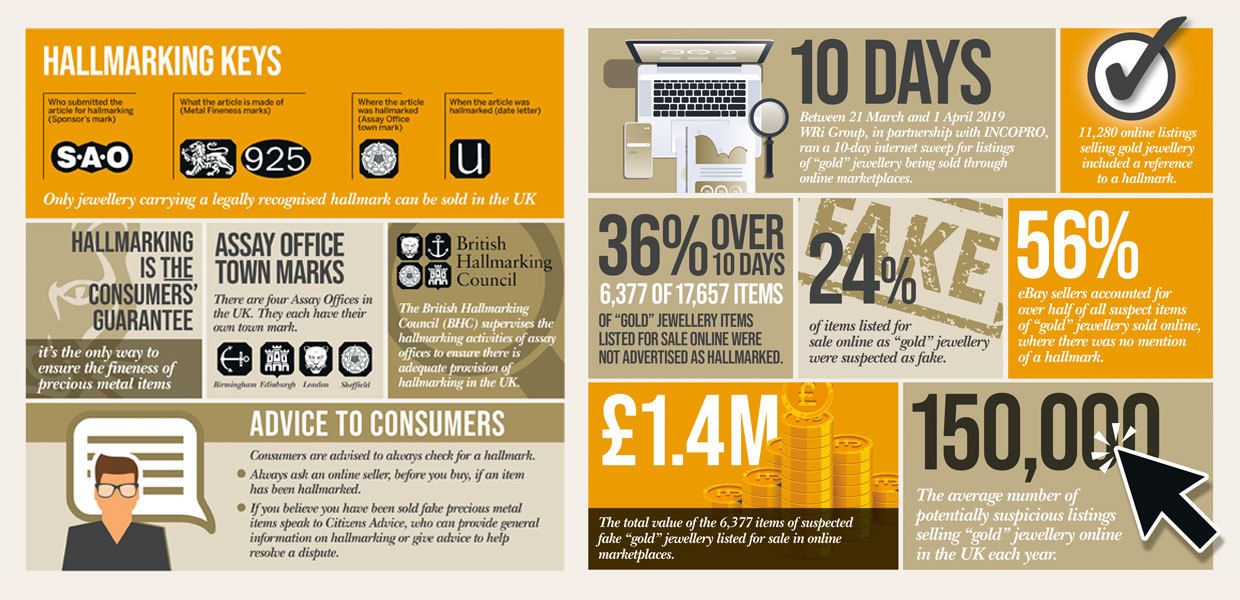

Hallmarks and Certifications- Look for hallmarks or marks that are recognized on gold-based items. These hallmarks give information about the authenticity, purity and weight of the gold. They are often provided by reputable assay office or government institutions. Purity Verification - Check for marks indicating fineness or karatage to verify the quality of the gold. In other words, 24 karat gold is pure, while lower karatages are indicative of various levels of alloying.

Reputable Sellers - Only buy gold from licensed or reputable dealers. They usually provide authentic certificates of authenticity as well as receipts with the specifications for gold.

Request documentation if you're purchasing gold, request the certificates of authenticity or of assay. These documents need to include information such as the weight, purity and the hallmark of gold.

Independent Verification- Ask for an independent verification or appraisal by an expert from a third party. They can verify the quality of the gold and determine the authenticity of the gold.

Verifying gold bullion and coins is an exercise that involves due diligence and relying on reputable sources. You should also acquire the required documentation to prove you are purchasing high-quality and genuine gold. Take a look at the best buy Bohemia coins hints for blog tips including apmex gold, 24 karat gold coin, gold exchange traded funds, silver double eagle, buy gold coins near me, gold and bullion, golden dime, buying gold online, chinese gold coins, 1 10 american gold eagle and more.

What Is A Small Mark-Up On The Stock Market And A Small Price Spread For Gold?

In gold trading the low price markup and spread are the expenses involved in purchasing or selling gold when compared to market prices. These terms refer to the amount of extra cash you'll have to pay (markup), or the difference between the selling and buying price (spread) which is higher than the market value for gold. Low mark-up - This refers to a dealer charging an amount that is minimally higher than the market price. A low markup occurs when the price you are paying for gold is barely or not at all more than the market price at which it is currently.

Low Price Spread - The spread can be described as the gap between gold's buying (bid) price and the selling (ask). A low price difference indicates a tighter spread between these two prices.

What Is The Difference In Prices And Margins Of Different Dealers In Gold?

There are some general factors that can affect the price of gold. These include business models, operational expenses, reputation and pricing strategies. The following are some general details regarding the variations: Quality of service and reputation of the dealer- A well-known and trusted dealer might charge more because of perceived quality, customer service, and trustworthiness. In the opposite situation, dealers who are newer and less established may offer lower mark-ups to customers to gain their business.

Cost of overhead and business model- Dealers offering high-end services or physical storefronts might have higher overhead costs to pay for. They therefore mark up their prices in order to compensate. Dealers who are online and have lower operating costs may provide more competitive prices.

Pricing Transparency - Dealers who offer transparent pricing typically offer lower markups and smaller spreads to attract customers who want fair and clear pricing.

In light of these factors it is crucial to ensure that gold buyers conduct their research, compare the prices offered by multiple dealers, and consider other aspects besides spreads and markups. These include reliability, reputation, and customer satisfaction. Compare rates and compare quotes from a variety of sources. Take a look at the recommended buy Charles III gold price for blog recommendations including $20 gold piece, gold stocks, $50 gold piece, 1oz of gold, american gold eagle, $5 gold coin, 1972 gold dollar, platinum coins, purchase gold, barrick gold stocks and more.